Oil Market Report - March 2025

About this report

The IEA Oil Market Report (OMR) is one of the world's most authoritative and timely sources of data, forecasts and analysis on the global oil market – including detailed statistics and commentary on oil supply, demand, inventories, prices and refining activity, as well as oil trade for IEA and selected non-IEA countries.

Highlights

- Growth in global oil demand is set to accelerate to just over 1 mb/d this year, from 830 kb/d in 2024, reaching 103.9 mb/d. Asia accounts for almost 60% of gains, led by China where petrochemical feedstocks will provide the entirety of growth. Amid an unusually uncertain macroeconomic climate, recent delivery data have been below expectations, leading to slightly lower estimates for 4Q24 and 1Q25 growth at 1.2 mb/d y-o-y.

- World oil supply rose by 240 kb/d in February to 103.3 mb/d, led by OPEC+. Kazakhstan pumped at an all-time high as Tengiz ramped up, while Iran and Venezuela boosted flows ahead of tighter sanctions. Non-OPEC+ production is set to rise by 1.5 mb/d in 2025, led by the Americas. Following a 770 kb/d output decline last year, OPEC+ output could hold steady in 2025 if voluntary cuts are maintained after April.

- Global crude runs dropped by 570 kb/d m-o-m to 82.8 mb/d in February, extending their decline from December’s five-year high of 84.3 mb/d, on planned and unplanned outages. Throughputs are forecast to average 83.3 mb/d in 2025, up 570 kb/d y-o-y as lower OECD activity partly offsets a 930 kb/d annual increase in the non-OECD. Refining margins recovered in February, as falling crude prices lifted profitability in all regions.

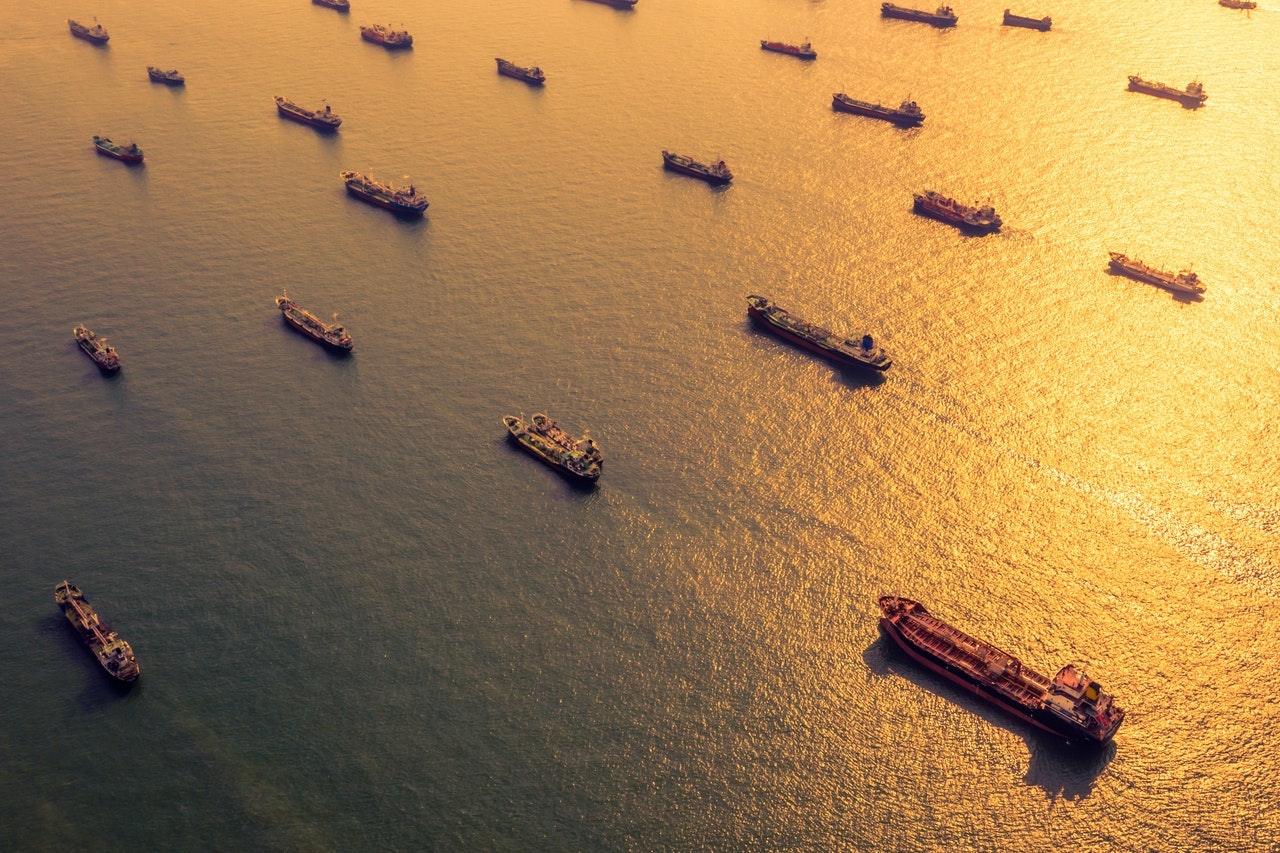

- Global observed oil stocks fell by 40.5 mb in January, of which 26.1 mb were products. Non‑OECD crude stocks plunged by 45.3 mb, dominated by China where imports declined. Total OECD stocks rose by 11.2 mb, boosted by a 25 mb build in industry crude inventories. Oil on water fell by 6.7 mb. However, preliminary data for February show total global oil stocks rebounded, lifted by an increase in oil on water.

- Oil prices declined by about $7/bbl in February and early March as macro sentiment soured amid escalating trade tensions, clouding the outlook for oil demand growth. Plans by OPEC+ to start unwinding voluntary production cuts in April added to the expectation of comfortable crude balances in 2025. At the time of writing, Brent futures were trading near three-year lows around $70/bbl.

Shifting sands

Benchmark crude oil prices fell in February and early March as concerns mounted over the outlook for the economy and global oil demand growth amid escalating trade tensions and as OPEC+ announced it would start unwinding production cuts in April. Against this backdrop, discussions started on the potential for an initial ceasefire and an eventual peace deal in Ukraine. ICE Brent futures declined by $11/bbl over the past eight weeks, trading near three-year lows around $70/bbl at the time of writing.

The macroeconomic conditions that underpin our oil demand projections deteriorated over the past month as trade tensions escalated between the United States and several other countries. New US tariffs, combined with escalating retaliatory measures, tilted macro risks to the downside. Recent oil demand data have underwhelmed, and growth estimates for 4Q24 and 1Q25 have been marginally downgraded to around 1.2 mb/d, with data for both advanced and developing markets coming in below projections. Nevertheless, global oil demand growth is still expected to average just over 1 mb/d this year, up from 830 kb/d in 2024, boosted in part by lower oil prices. Asian countries will account for almost 60% of gains, led by China where petrochemical feedstocks will provide the entirety of growth as demand for refined fuels reaches a plateau.

While the actual supply boost from the gradual unwinding of OPEC+ production cuts in April may end up being less than the nominal 138 kb/d increase, global oil supply is already on the rise. In February, it jumped 240 kb/d as Tengizchevroil ramped up its long-delayed Tengiz expansion project, pushing Kazakh output to all-time highs. Elsewhere, Iran and Venezuela boosted flows ahead of tighter sanctions. Venezuelan supply is expected to decline from April, when Chevron’s General License to operate in the country expires. At the same time, the increase from the eight OPEC+ members party to the voluntary cuts agreed in November 2023 may be less than 50 kb/d, as only Saudi Arabia – and to a much lesser extent, Algeria – have room to raise production to the new targets. The other members party to the deal collectively overproduced by 1.2 mb/d in February, according to IEA estimates.

The United States is currently producing at record highs and is forecast to be the largest source of supply growth in 2025, followed by Canada, Brazil and Guyana. Proposed US tariffs on Canada and Mexico, set to take effect on 1 April, may impact flows and prices from the two countries that accounted for roughly 70% of US crude oil imports last year. Meanwhile, the latest round of sanctions on Russia and Iran has yet to significantly disrupt loadings, even as some buyers have scaled back purchases.

Risks to the market outlook remain rife and uncertainties abound. Our current balances suggest global oil supply may exceed demand by around 600 kb/d this year. If OPEC+ extends the unwinding of output cuts beyond April without reining in supply from members currently overproducing versus their targets, another 400 kb/d could be added to the market. Equally, the scope and scale of tariffs remains unclear, and with trade negotiations continuing apace, it is still too early to assess the impact on the market outlook.

OPEC+ crude oil production1

million barrels per day

| Jan 2025 Supply |

Feb 2025 Supply |

Feb 2025 vs Target |

Feb 2025 Implied Target1 |

Sustainable Capacity2 |

Eff Spare Cap vs Feb3 |

|

|---|---|---|---|---|---|---|

| Algeria | 0.88 | 0.9 | -0.01 | 0.91 | 0.99 | 0.08 |

| Congo | 0.24 | 0.24 | -0.04 | 0.28 | 0.27 | 0.03 |

| Equatorial Guinea | 0.06 | 0.06 | -0.01 | 0.07 | 0.06 | 0.0 |

| Gabon | 0.25 | 0.23 | 0.05 | 0.18 | 0.22 | 0 |

| Iraq | 4.3 | 4.3 | 0.3 | 4 | 4.87 | 0.57 |

| Kuwait | 2.48 | 2.44 | 0.03 | 2.41 | 2.88 | 0.43 |

| Nigeria | 1.51 | 1.44 | -0.06 | 1.5 | 1.42 | 0 |

| Saudi Arabia | 9.07 | 8.99 | 0.02 | 8.98 | 12.11 | 3.12 |

| UAE | 3.2 | 3.28 | 0.37 | 2.91 | 4.28 | 1.0 |

| Total OPEC-9 | 21.98 | 21.89 | 0.66 | 21.24 | 27.1 | 5.23 |

| Iran4 | 3.34 | 3.39 | 3.8 | |||

| Libya4 | 1.23 | 1.24 | 1.23 | 0 | ||

| Venezuela4 | 0.86 | 0.94 | 0.89 | 0 | ||

| Total OPEC | 27.42 | 27.46 | 33.02 | 5.23 | ||

| Azerbaijan | 0.48 | 0.47 | -0.08 | 0.55 | 0.49 | 0.02 |

| Kazakhstan | 1.56 | 1.78 | 0.31 | 1.47 | 1.8 | 0.02 |

| Mexico5 | 1.42 | 1.47 | 1.59 | 0.12 | ||

| Oman | 0.74 | 0.76 | 0.0 | 0.76 | 0.85 | 0.09 |

| Russia | 9.2 | 9.12 | 0.15 | 8.98 | 9.76 | |

| Others 6 | 0.76 | 0.72 | -0.15 | 0.87 | 0.86 | 0.13 |

| Total Non-OPEC | 14.16 | 14.33 | 0.24 | 12.62 | 15.34 | 0.38 |

| OPEC+ 18 in Nov 2022 deal5 | 34.72 | 34.75 | 0.89 | 33.86 | 40.85 | 5.49 |

| Total OPEC+ | 41.57 | 41.78 | 48.36 | 5.61 |

1. Includes extra voluntary curbs and revised, additional compensation cutback volumes. 2. Capacity levels can be reached within 90 days and sustained for an extended period. 3. Excludes shut in Iranian, Russian crude. 4. Iran, Libya, Venezuela exempt from cuts. 5. Mexico excluded from OPEC+ compliance. 6. Bahrain, Brunei, Malaysia, Sudan and South Sudan.

Oil Market Report Documentation

Definitions of key terms used in the OMR.

For more info on the methodology, download the PDF below.