Small Business Optimism Index

Small Business Optimism Index

Overview

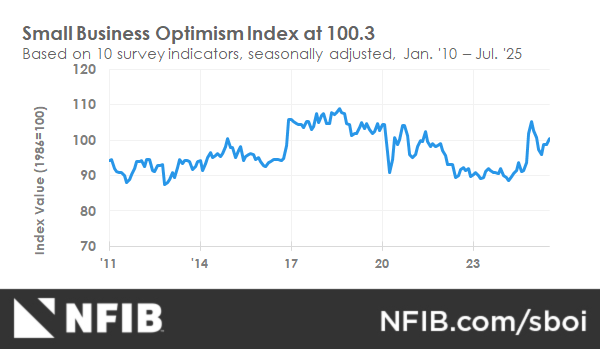

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in July 2025.

July 2025: Small Business Optimism Rises

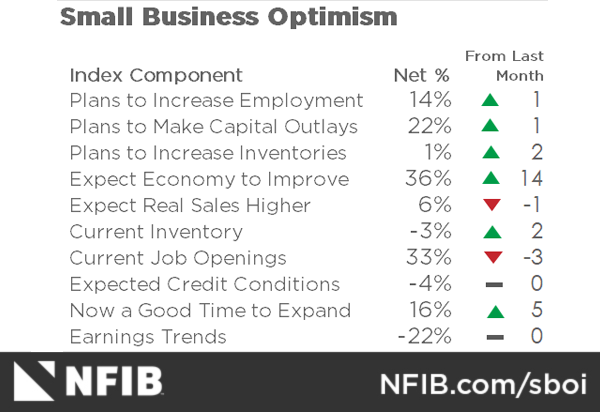

The NFIB Small Business Optimism Index rose 1.7 points in July to 100.3, slightly above the 52-year average of 98. Contributing most to the rise in the Optimism Index were respondents reporting better business conditions and reporting that it is a good time to expand. In contrast to the Optimism Index, the Uncertainty Index increased by eight points from June to 97. Twenty-one percent of small business owners reported labor quality as their single most important problem, up five points from June and ranking as the top problem.

Optimism rose slightly in July with owners reporting more positive expectations on business conditions and expansion opportunities. While uncertainty is still high, the next six months will hopefully offer business owners more clarity, especially as owners see the results of Congress making the 20% Small Business Deduction permanent and the final shape of trade policy. Meanwhile, labor quality has become the top issue on Main Street again.

NFIB Chief Economist Bill Dunkelberg

In July, there was a notable improvement in overall business health. When asked to rate the overall health of their business, 13% reported excellent (up five points), and 52% reported good (up three points). Thirty-one percent reported the health of their business was fair (down four points), and 4% reported poor (down three points).

The percent of small business owners reporting poor sales as their top business problem rose one point to 11%. This is the highest level of poor sales since February 2021.

The percent of small business owners reporting poor sales as their top business problem rose one point to 11%. This is the highest level of poor sales since February 2021.

The net percent of owners expecting better business conditions rose 14 points from June to a net 36% (seasonally adjusted). This reading is comfortably above the historical average.

The net percent of owners expecting better business conditions rose 14 points from June to a net 36% (seasonally adjusted). This reading is comfortably above the historical average.

In July, 16% (seasonally adjusted) reported that it is a good time to expand their business, up five points from June.

In July, 16% (seasonally adjusted) reported that it is a good time to expand their business, up five points from June.

Eleven percent of owners reported that inflation was their single most important problem in operating their business, unchanged from June’s lowest reading since September 2021.

Eleven percent of owners reported that inflation was their single most important problem in operating their business, unchanged from June’s lowest reading since September 2021.

The net percent of owners expecting higher real sales volumes fell one point from June to a net 6% (seasonally adjusted). Though expected real sales are higher than actual sales, the current reading is also comfortably below the 52-year average.

The net percent of owners expecting higher real sales volumes fell one point from June to a net 6% (seasonally adjusted). Though expected real sales are higher than actual sales, the current reading is also comfortably below the 52-year average.

Twenty-two percent (seasonally adjusted) plan capital outlays in the next six months, up one point from June, but seven points below the historical average of 29%.

Twenty-two percent (seasonally adjusted) plan capital outlays in the next six months, up one point from June, but seven points below the historical average of 29%.

As reported in NFIB’s monthly jobs report, a seasonally adjusted 33% of all small business owners reported job openings they could not fill in July, down three points from June and the lowest level since December 2020, though still well above its monthly historical average of 25%. Of the 57% of owners hiring or trying to hire in June, 84% reported few or no qualified applicants for the positions they were trying to fill. A seasonally adjusted net 14% of owners plan to create new jobs in the next three months, up one point from June.

The percent of business owners reporting labor costs as the single most important problem fell one point from June to 9%.

Seasonally adjusted, a net 27% reported raising compensation, down six points from June. A seasonally adjusted net 17% plan to raise compensation in the next three months, down two points from June.

Fifty-five percent of small business owners reported capital outlays in the last six months, up five points from June’s lowest reading since August 2020.

Of those making expenditures, 38% reported spending on new equipment, 23% acquired vehicles, and 15% improved or expanded facilities. Twelve percent spent money on new fixtures and furniture and 5% acquired new buildings or land for expansion.

A net negative 9% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down four points from June.

The net percent of owners reporting inventory gains remained at a net negative 8%, seasonally adjusted. Not seasonally adjusted, 12% reported increases in stocks, and 17% reported reductions. A net negative 3% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in July, two points higher than June’s negative 5% reading.

Seasonally adjusted, a net 28% plan to increase prices, down four points from June. As with actual price changes, this is well above its historical average and is a signal of continued inflation. The net percent of owners raising average selling prices fell five points from June to a net 24%, seasonally adjusted. Unadjusted, 12% of owners reported lower average selling prices, and 37% reported higher average prices.

The frequency of reports of positive profit trends remained at a net negative 22% (seasonally adjusted) in July. Among owners reporting lower profits, 34% blamed weaker sales, 13% cited the rise in the cost of materials, 11% cited labor costs, and 9% cited price change for their product(s) or service(s). For owners reporting higher profits, 48% credited sales volumes, 30% cited usual seasonal change, and 10% cited higher selling prices.

Four percent of owners reported that financing and interest rates were their top business problem in July, up one point from June. Twenty-five percent of all owners reported borrowing on a regular basis, down one point from June and a historically low reading. A net 4% reported their last loan was harder to get than in previous attempts, down one point from June. A net 5% reported paying a higher rate on their most recent loan, down four points from June and matching the monthly average.

Seventeen percent of small business owners reported taxes as their single most important problem, down two points from June and ranking as the second top problem. The percent of small business owners reporting government regulations and red tape as their single most important problem fell one point to 8%, making it the fifth most important issue overall. Six percent reported competition from large businesses as their single most important problem, down one point from June.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in July 2025.

Labor Market

In July, 33 percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down 3 points from June and the lowest level since December 2020, though still well above its monthly historical average of 25 percent. Twenty-nine percent had openings for skilled workers (down 1 point), and 12 percent had openings for unskilled labor (down 1 point). The difficulty in filling open positions is particularly acute in the construction, wholesale, and transportation industries. Openings were the lowest in the finance and agriculture industries. Over half (55 percent) of small businesses in the construction industry had a job opening they could not fill, up 2 points from last month. Only 13 percent of businesses in the finance industry reported unfilled job openings in July, a decrease of 14 points from June. A seasonally adjusted net 14 percent of owners plan to create new jobs in the next three months, up 1 point from June. This remains above the historical average of net 11 percent. Overall, 57 percent reported hiring or trying to hire in July, down 1 point from June. Fortyeight percent (84 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill (down 2 points). Twenty-nine percent of owners reported few qualified applicants for their open positions (up 4 points), and 19 percent reported none (down 6 points). In July, 21 percent of small business owners cited labor quality as their single most important problem, up 5 points from June and the largest monthly increase since August 2022. Labor costs reported as the single most important problem for business owners fell 1 point from June to 9 percent.

Capitol Spending

Fifty-five percent of small business owners reported capital outlays in the last six months, up 5 points from June’s lowest reading since August 2020. Of those making expenditures, 38 percent reported spending on new equipment (up 5 points), 23 percent acquired vehicles (up 5 points), and 15 percent improved or expanded facilities (up 2 points). Twelve percent spent money on new fixtures and furniture (up 3 points), and 5 percent acquired new buildings or land for expansion (up 2 points). Twenty-two percent (seasonally adjusted) plan capital outlays in the next six months, up 1 point from June, but 7 points below the historical average of 29 percent.

Inflation

The net percent of owners raising average selling prices, fell 5 points from June to a net 24 percent seasonally adjusted. Despite the decline, price increases remain above the average of net 13 percent, suggesting continued inflationary pressure. Eleven percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), unchanged from June’s lowest reading since September 2021. Unadjusted, 37 percent reported higher average prices (down 5 points), and 12 percent reported lower average selling prices (up 1 point). Price hikes were most frequent in wholesale (68 percent higher, 5 percent lower), finance (52 percent higher, 11 percent lower), retail (50 percent higher, 4 percent lower), and construction (42 percent higher, 8 percent lower). Looking forward, a net 28 percent (seasonally adjusted) plan to increase prices, down 4 points from June. As with actual price changes, this is well above its historical average and is a signal of continued inflation.

Credit Markets

A net 4 percent reported their last loan was harder to get than in previous attempts, down 1 point from June. Four percent reported that financing and interest rates were their top business problem in July, up 1 point from June. In July, a net 5 percent of owners reported paying a higher rate on their most recent loan, down 4 points from June and matching the monthly average. In July, the average rate paid on short maturity loans was 8.7 percent, down 0.1 of a point from June. Twentyfive percent of all owners reported borrowing on a regular basis, down 1 point from June and a historically low reading.

Compensation and Earnings

In July, businesses reported slowdowns in both planned and actual labor compensation increases. Seasonally adjusted, a net 27 percent reported raising compensation, down 6 points from June. A seasonally adjusted net 17 percent plan to raise compensation in the next three months, down 2 points from June. The frequency of reports of positive profit trends remained at a net negative 22 percent (seasonally adjusted). Among owners reporting lower profits, 34 percent blamed weaker sales, 13 percent cited the rise in the cost of materials, 11 percent cited labor costs, and 9 percent cited price change for their product(s) or service(s). Among owners reporting higher profits, 48 percent cited sales volume, 30 percent cited usual seasonal change, and 10 percent cited higher selling prices.

Sales and Inventories

A net negative 9 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 4 points from June’s negative five, which was the highest reading since January 2023. These numbers remain below the historical average of zero. The net percent of owners expecting higher real sales volumes fell 1 point from June to a net 6 percent (seasonally adjusted). Though expected real sales are higher than actual sales, the current reading is also comfortably below the 52-year average. The net percent of owners reporting inventory gains remained at a net negative 8 percent (seasonally adjusted). Not seasonally adjusted, 12 percent reported increases in stocks (down 2 points), and 17 percent reported reductions (down 1 point). A net negative 3 percent (seasonally adjusted) of owners viewed current inventory stocks as “too low” in July, 2 points higher than June’s negative 5 percent reading. A net 1 percent (seasonally adjusted) of owners plan inventory investment in the coming months, up 2 points from June.

Outlook

In July, there was a notable improvement in overall business health. When asked to rate the overall health of their business, 13 percent reported excellent (up 5 points), and 52 percent reported good (up 3 points). Thirty-one percent reported the health of their business was fair (down 4 points), and 4 percent reported poor (down 3 points). The net percent of owners expecting better business conditions rose 14 points from June to a net 36 percent (seasonally adjusted). Historically this is a very positive reading. In July, 16 percent (seasonally adjusted) reported that it is a good time to expand their business, up 5 points from June.

Single Most Important Problem

In July, the percent of small business owners reporting labor quality as the single most important problem for their business rose to 21 percent, up 5 points from June and ranking as the top problem. Labor costs reported as the single most important problem for business owners fell 1 point from June to 9 percent. Seventeen percent of small business owners reported taxes as their single most important problem, down 2 points from June and ranking as the second top problem. The percent of small business owners reporting government regulations and red tape as their single most important problem fell 1 point to 8 percent, making it the fifth-most important issue overall. Eleven percent of owners reported that inflation was their single most important problem in operating their business, unchanged from June’s lowest reading since September 2021. The percent of small business owners reporting poor sales as their top business problem rose 1 point to 11 percent. The last time poor sales was this high was February 2021. In July, 8 percent reported the cost or availability of insurance as their single most important problem, unchanged from June. Four percent reported that financing and interest rates were their top business problem in July, up 1 point from June. Six percent reported competition from large businesses as their single most important problem, down 1 point from June.

Commentary

GDP measures production (income) in the domestic economy. Buy a car made in the U.S. and GDP rises. Buy a foreign car and it does not. Its cost reflects output generated in other countries. Focusing spending on imports in anticipation of higher tariffs lowered GDP, which posted negative growth in the first quarter. In the second quarter, spending domestically instead boosted GDP growth (+3%). Looking at final domestic sales, growth was just above 1%. Growth in consumption, which accounts for two-thirds of GDP, was about 1.5%. Overall, the economy is still trending sideways and a bit southward. Interest rates remain unchanged and are higher than expected, although prospects for cuts in the Fed’s policy rate in the next few months are very good. The small business sector is waiting for the rollout of the One Big Beautiful Bill provisions and the final shape of the tariffs. Uncertainty remains high.

The S&P 500 and the NASDAQ are at record high levels, so all must be good, right? Those are broad measures of economic activity, and high stock prices mean that investors are optimistic about the future. Shifting from Wall Street, Main Street indicators are more mixed. Overall consumer sentiment is low compared to historical norms, though sharply divided along partisan lines. Since October 2024, the University of Michigan’s sentiment data for Democrat-leaning consumers has fallen from 91.6 to 41.0 (Table 34). For Republicans, the Index rose from 50.2 to 93.1. Opinions about government policy are similarly bifurcated, with Democrat falling from 146 to 12 while the Republican Index rose from 24 to 146. Small business sentiment remains moderate, although it ticked higher this month. This is not conducive for investment spending needed to improve our productivity and produce new goods and services.

Uncertainty is high and rising, with tariffs, inflation, and international conflict such as in Gaza all sources of doubt. The Uncertainty Index rose 8 points to its fifth highest reading ever, clouding decisions about hiring, pricing, investment in plant and equipment. The tension between President Trump’s goals, Democratic opposition, and undecided court cases adds to uncertainty and the level of discomfort in the economy. The next six months will hopefully offer clarity and resolutions to most of the issues that trouble consumers and policy makers, giving businesses greater certainty, confidence, and ability to invest.

Quotes from NFIB Members

“Increased costs are affecting everyone. I believe things will improve, but it will take time – six to 12 months. I just hope small businesses can hold on that long.” – Fabricated Metal Product Manufacturing, MI

“Corn and soybean prices are too low, particularly corn. I usually contract 50% or more ahead, but prices have not been at profitable levels therefore I have contracted next to nothing. We are operating at approximately 25% below cost of production. We still experience some supply chain disruptions such as waiting for repair parts and other inputs. Inputs such as seed, fertilizer, and herbicides have not decreased in price. They still rise steadily.” – Agriculture, IN

“Too many regulations to file reports for that have no annual notices to remind you to do and may be totally unaware of and could get fined if you don’t. Examples: OSHA Annual Accident/Hour report, BOI Reporting filing, RMD withdrawal report for a few. A small business is usually a one man show, and he has plenty of other things going on.” – Retail, NE